Expert's Opinion

Spatial Data Mastery in P&C Insurance and Reinsurance

Liked what you read?

Subscribe to our monthly newsletter to receive the latest blogs, news and updates.

Contents

Introduction

“At this point, there are no non-spatial perils.”

Is it true? That all catastrophes – natural and man-made – have a spatial component to them? And if so, what are the implications of this to the P&C Insurance and Reinsurance segments?

In the latest edition of the Ellipsis Drive podcast, industry experts Randy Liu, from SCOR, and Todd Barr, from Verisk, provided invaluable insights on the importance of spatial data mastery within the insurance and reinsurance sector.

With a keen focus on understanding risks and the effective management of catastrophes, the conversation illuminated the significant challenges faced by industry professionals in leveraging spatial data to its fullest potential.

In this article, we’re going to capture the essence of that conversation and share some of the key pointers highlighted by Randy and Todd. Let’s go!

Understanding the Status Quo of P&C Reinsurance

Re/insurers play an essential role in safeguarding people and property against natural disasters and emerging man-made catastrophes worldwide. They do so by utilizing highly complex catastrophe models that have slowly become a mainstay within the industry.

However, due to the advent of climate change these models, built on knowledge of past events, are starting to turn obsolete. The past is no longer an accurate predictor of the future (it never was an ideal proxy, but that’s up for nitpicking later), and the industry is starting to feel the impact of this on their bottom lines.

“Losses caused by weather perils are definitely occurring with higher frequency and increased severity. And this is really challenging the models that we use today.” said Randy when asked about the impact of climate change on the re/insurance business.

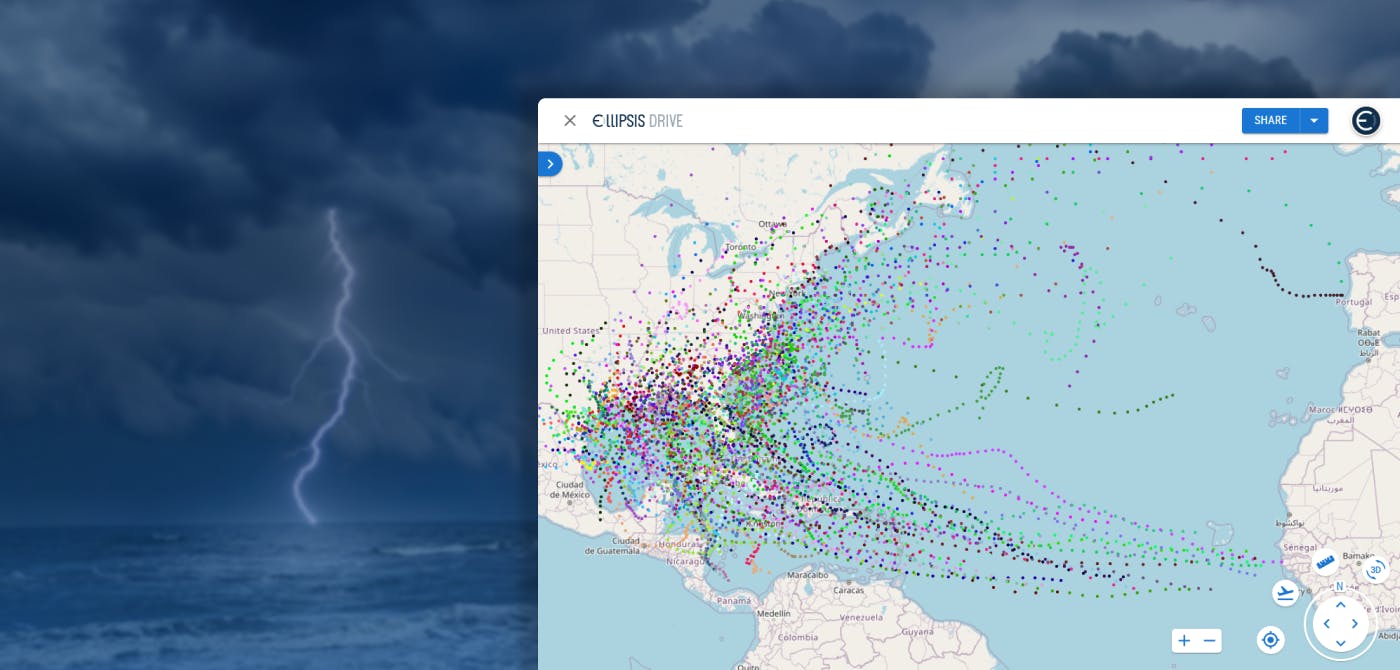

This was highlighted in the case of hurricane Otis, where the storm rapidly escalated from category 1 to 5 within 12 hours. Something that no model was able to predict, causing significant unexpected losses to the re/insurance industry.

The limitations of traditional models in capturing sudden changes underscores the industry's imperative to embrace innovative approaches. By acknowledging these challenges and encouraging greater flexibility in risk assessment, re/insurers can strengthen their resilience and better protect against evolving threats.

Let’s take a deeper look at some of these challenges that prevent the industry from embracing new and innovative modelling techniques.

Challenges in Spatial Data Modelling in Insurance and Reinsurance

- High Volumes of Data

Reinsurers sell insurance to direct insurance providers. The data (resolution) that they work with is often rolled up to a meter view, providing higher accuracy. However, reinsurers still have access to the (figurative) millimeter view as well. The sheer volume of data that the industry has to deal with is enormous. The landscape gets more complicated as the number of spatial data sources such as satellite imagery, in situ sensor data, drone imagery etc. is increasing.

Furthermore, because of the global nature of most reinsurer portfolios, the variety of tools being used and the number of people working on this data to distill intelligence creates a chaotic workflow.

Todd highlighted this issue and said, “One of our big data challenges is version control. We often have version one, two, three, up to twelve at times. If all the stakeholders are not working on the right version, there’s obviously going to be a major difference in the end analysis.”

Managing the vast volume of spatial data, often spanning many terabytes, presents a significant challenge for reinsurers. Ensuring large datasets' storage, processing, and analysis while maintaining data integrity and consistency is a huge task.

- Merging Datasets

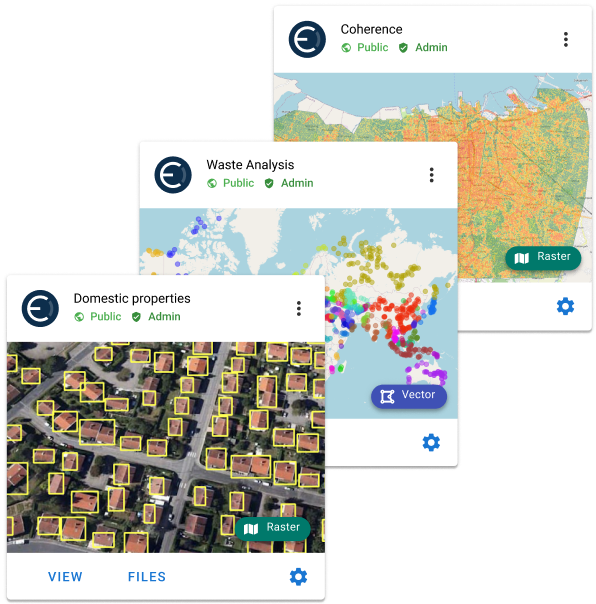

There's a growing recognition of the necessity to incorporate more geospatial analysis into risk models for improved accuracy. However, this transition poses challenges in terms of data integration and model refinement.

“It’s not a trivial exercise for insurers to attach geospatial characteristics to the policy data simply because they’re sitting on different systems. And geospatial data is useless unless you attach them to policy data”, said Randy.

Merging this data with policy information for precise risk assessment adds another layer of complexity, which ultimately shapes a struggle to align existing pricing and underwriting engines with evolving geospatial analytics. In essence, it's as if two disconnected worlds suddenly decided to merge processes. A merge which – as time passes – becomes more and more unavoidable.

- Data Discoverability & Visualization

Our guests' insights shed light on the significance of ensuring data discoverability and adopting effective visualization techniques to harness the full potential of spatial data. The industry faces significant hurdles in navigating through various Geographic Information System (GIS) software options and overcoming resistance to adopting new visualization methods.

“The number of tools that we have available to deal with the variety of data types itself is a big challenge for us to manage as a company. There are just so many GIS softwares available for visualization that it is difficult to ensure consistency.”, said Randy.

Visualization on a map is not even the hardest part. Learning new methodologies to run your analytics is where it gets tricky. Todd effectively pointed out that traditional visualization methodologies, such as concentric circles, may restrict the insights derived from spatial data, highlighting the urgent need for exploring advanced visualization techniques.

This inertia and reliance on established practices hinder the adoption of innovative spatial data management solutions. Overcoming this cultural resistance and fostering a culture of innovation are critical challenges for reinsurers as they strive to stay ahead in a rapidly evolving landscape.

Conclusion

It was clear from the discussion that reinsurers face significant challenges in mastering spatial data for effective risk management. Adapting to the evolving nature of catastrophic events, integrating spatial analysis into models, and overcoming obstacles in data management and visualization are key priorities for the industry. By addressing these challenges and embracing innovative approaches, reinsurers can enhance their resilience to tomorrow's risks.

We learned a lot through this exciting podcast. What we can be sure about is that spatial data mastery will be a key factor in the upcoming evolution of the insurance industry. We would like to thank Randy and Todd for sparing their valuable time and sharing their expertise with us.

Until next time!

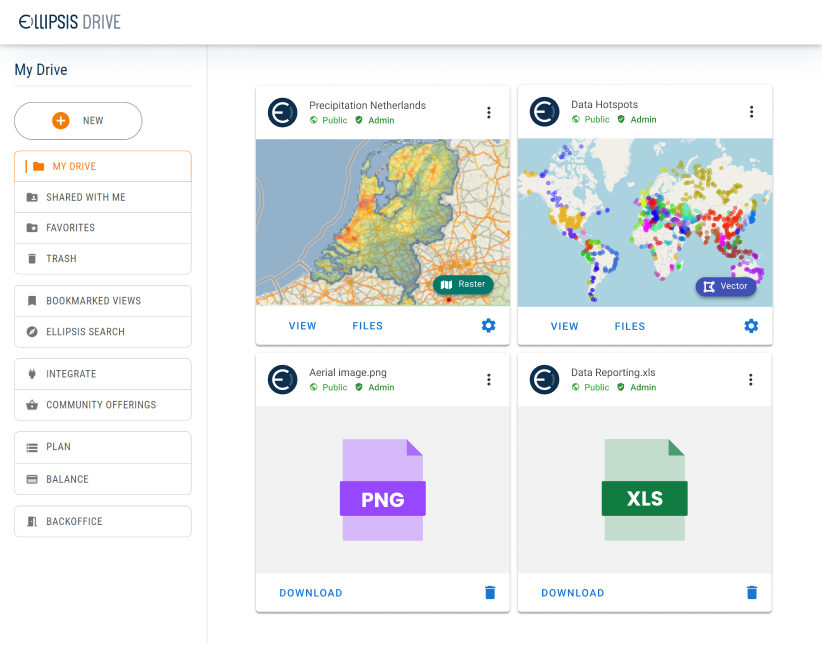

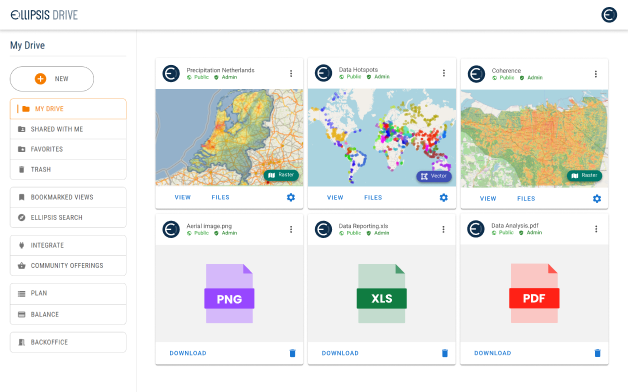

Take the Ellipsis Drive tour

in less than 2 minutes’

- A step-by-step guide on how to activate your geospatial data.

- Become familiar with our user-friendly interface & design

- View your data integration options