Insurance Analytics

Harnessing the Power of Spatial Data in Sustainable Insurance Practices

Contents

Introduction

The Insurance Sustainability Accounting Standard (ISAS) is a robust framework designed to guide and enhance sustainability reporting within the insurance industry. It provides insurers with a comprehensive set of metrics and disclosure topics to assess and communicate their sustainability performance. While the ISAS may not explicitly highlight spatial data as a standalone component, the incorporation of spatial data is vital in understanding and addressing location-specific risks, impacts, and opportunities. This article delves into the critical link between ISAS and spatial data, highlighting how insurers can harness the power of spatial data to drive sustainable practices and make informed decisions.

Understanding the Insurance Sustainability Accounting Standard (ISAS)

The Insurance Sustainability Accounting Standard (ISAS) serves as a crucial framework that promotes sustainability reporting within the insurance industry. Its primary objective is to guide insurers in measuring and communicating their sustainability performance effectively. By providing a comprehensive set of metrics and disclosure topics, the ISAS enables insurers to assess the environmental, social, and governance (ESG) factors that are relevant to their operations.

The ISAS encompasses various key components and disclosure topics that facilitate a holistic assessment of sustainability performance. These include climate change, natural disasters, product responsibility, customer relations, labour practices, and business ethics. By addressing these topics, insurers can gain a comprehensive understanding of their impact on society and the environment.

The importance of the ISAS lies in its ability to enhance transparency, accountability, and responsible business practices in the insurance industry. Through standardized metrics and disclosure requirements, the ISAS promotes consistency in reporting and enables stakeholders to compare and evaluate insurers' sustainability efforts effectively. This helps build trust, fosters long-term relationships with customers and investors, and positions insurers as responsible corporate citizens.

Spatial Data Integration in Sustainability Reporting

Spatial data plays a vital role in understanding and addressing location-specific risks, impacts, and opportunities within the insurance sector. By incorporating spatial data into sustainability reporting, insurers can gain deeper insights and make more informed decisions.

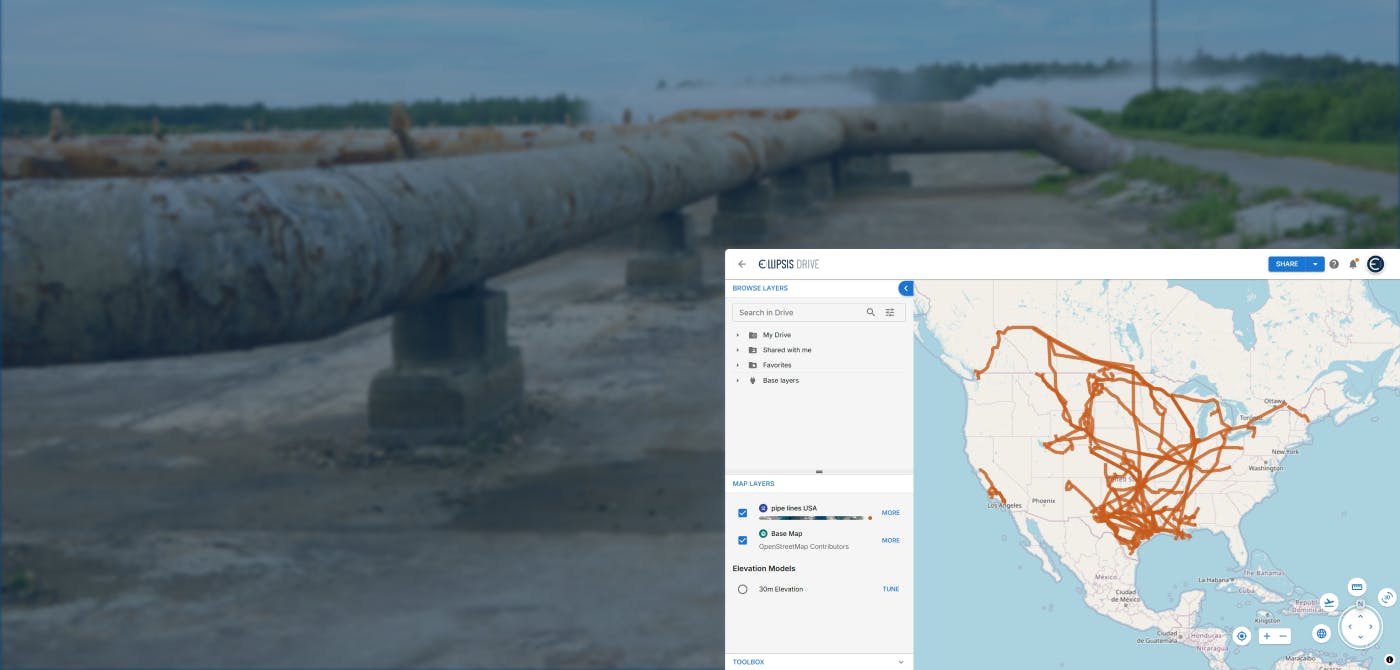

Spatial data refers to information that is geographically referenced, such as maps, satellite imagery, and location-based datasets. In the insurance context, spatial data provides valuable insights into location-specific risks, such as climate change impacts, natural disasters, and environmental factors. By analyzing spatial data, insurers can identify high-risk areas, assess exposure to potential hazards, and develop targeted risk management strategies.

Spatial data integration within the ISAS framework is particularly relevant in underwriting practices. Insurers can leverage spatial data to assess the risks associated with specific locations, such as flood-prone areas or regions susceptible to wildfires. This enables them to tailor their underwriting policies and pricing models accordingly, ensuring a more accurate assessment of risk and appropriate premium structures.

Furthermore, spatial data integration is essential in addressing product responsibility. By incorporating location-specific data, insurers can evaluate the social and environmental impacts of their insurance offerings in different regions. This includes assessing the sustainability performance of insured properties, such as energy efficiency or adherence to environmental regulations, which can vary across locations.

By leveraging spatial data, insurers can enhance their risk assessment capabilities, make more informed underwriting decisions, and develop tailored sustainability initiatives that address location-specific challenges and opportunities.

Leveraging Spatial Data for Sustainable Insurance Practices

Real-world case studies exemplify how insurers can effectively harness spatial data within the ISAS framework to drive sustainable insurance practices:

Case Study 1: Climate Change Mitigation and Adaptation Strategies

- In this case study, a global insurer utilizes spatial data to map climate change risks and vulnerabilities. By integrating data on sea-level rise, extreme weather events, and temperature variations, the insurer identifies areas that require proactive measures for mitigation and adaptation.

- The insurer tailors its underwriting practices to reflect the climate risks associated with specific locations, adjusting coverage terms and premiums accordingly. They also collaborate with policyholders to implement resilience measures, such as incentivizing sustainable building practices or offering discounts for climate-friendly renovations.

Case Study 2: Product Development and Responsible Investment Decisions

- This case study highlights how an insurer incorporates spatial data in product development and responsible investment decisions. By analyzing spatial data on environmental indicators, demographic profiles, and socio-economic factors, the insurer identifies areas with specific needs and targets its product offerings accordingly.

- The insurer actively invests in renewable energy projects in regions with high solar or wind potential, aligning its investments with its sustainability objectives and contributing to the transition to a low-carbon economy.

Case Study 3: Stakeholder Engagement and Communication

- In this case study, an insurer leverages spatial data visualization to enhance stakeholder engagement and communication. By presenting sustainability reports with spatially visualized data, the insurer effectively communicates the geographical distribution of its operations, environmental impacts, and community engagement efforts.

- The insurer utilizes interactive maps and charts to highlight sustainability initiatives and social investments in specific regions, fostering transparency and building trust among stakeholders.

These case studies demonstrate the practical applications of spatial data integration within the ISAS framework, enabling insurers to proactively address sustainability challenges and leverage location-specific insights for driving positive environmental and social impact.

Overcoming Challenges and Implementing Best Practices

While spatial data integration offers significant benefits, there are challenges to consider when implementing it in sustainability reporting:

Challenge 1: Data Quality, Availability and usability

- Insurers must ensure the quality, accuracy, and reliability of spatial data. This requires robust data collection processes, data validation techniques, and collaboration with reliable daprita providers.

- Additionally, insurers should address data gaps and limitations to ensure comprehensive and representative spatial data coverage.

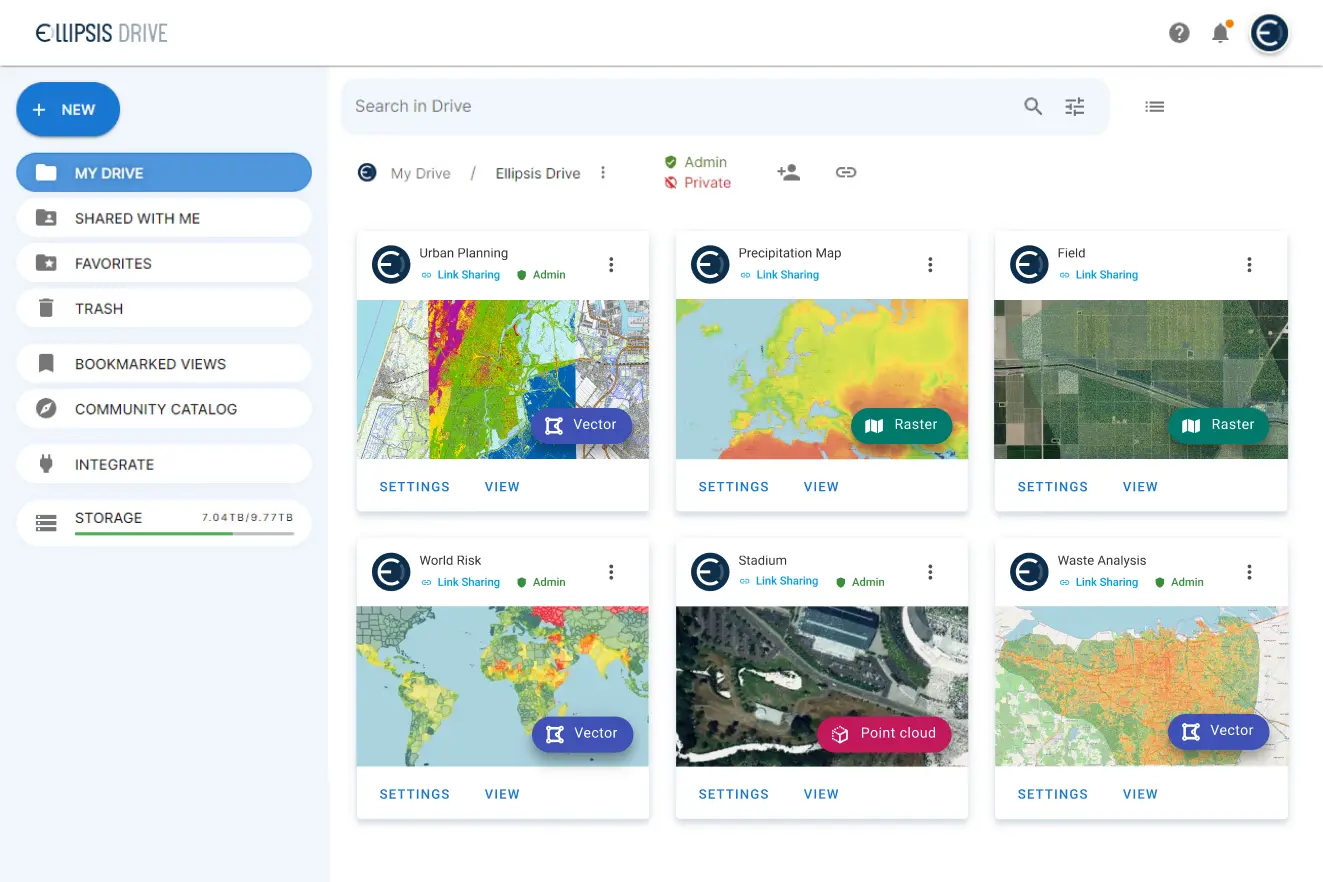

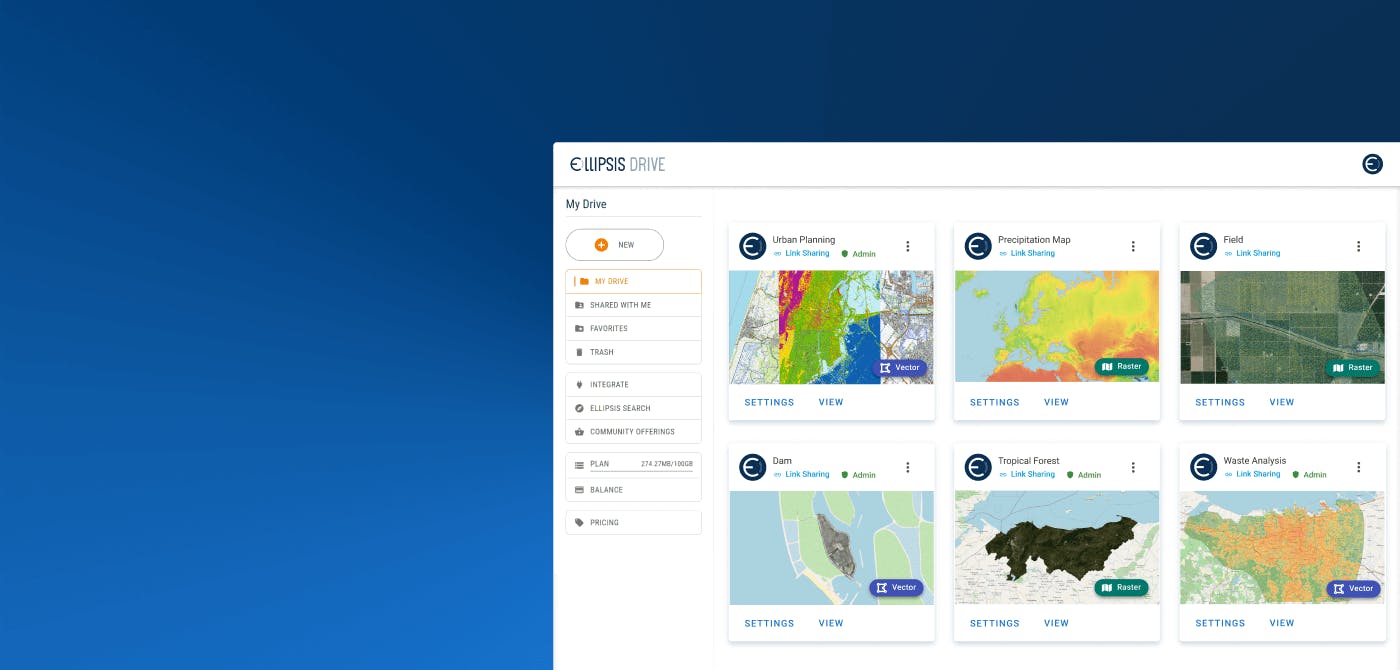

- Lastly, insurers need to host and manage data in a place where authorized audiences have up-to-date and synchronized access to relevant data via fitting endpoints.

Challenge 2: Privacy and Confidentiality

- Spatial data often contains sensitive information, such as property addresses or personal details. Insurers must navigate privacy regulations and implement data protection measures to safeguard customer privacy while utilizing spatial data effectively.

Challenge 3: Technology and Infrastructure

- Implementing spatial data integration requires appropriate technology infrastructure and analytical tools. Insurers may need to invest in geospatial software, data management systems, and skilled personnel to handle spatial data effectively.

To overcome these challenges, insurers can implement best practices:

Best Practice 1: Data Partnerships and Collaboration

- Establish partnerships with reputable data providers, research institutions, or government agencies to access reliable and up-to-date spatial data.

- Collaborate with industry peers to share best practices, overcome data challenges, and develop industry-wide standards for spatial data integration.

Best Practice 2: Advanced Analytics and Modeling

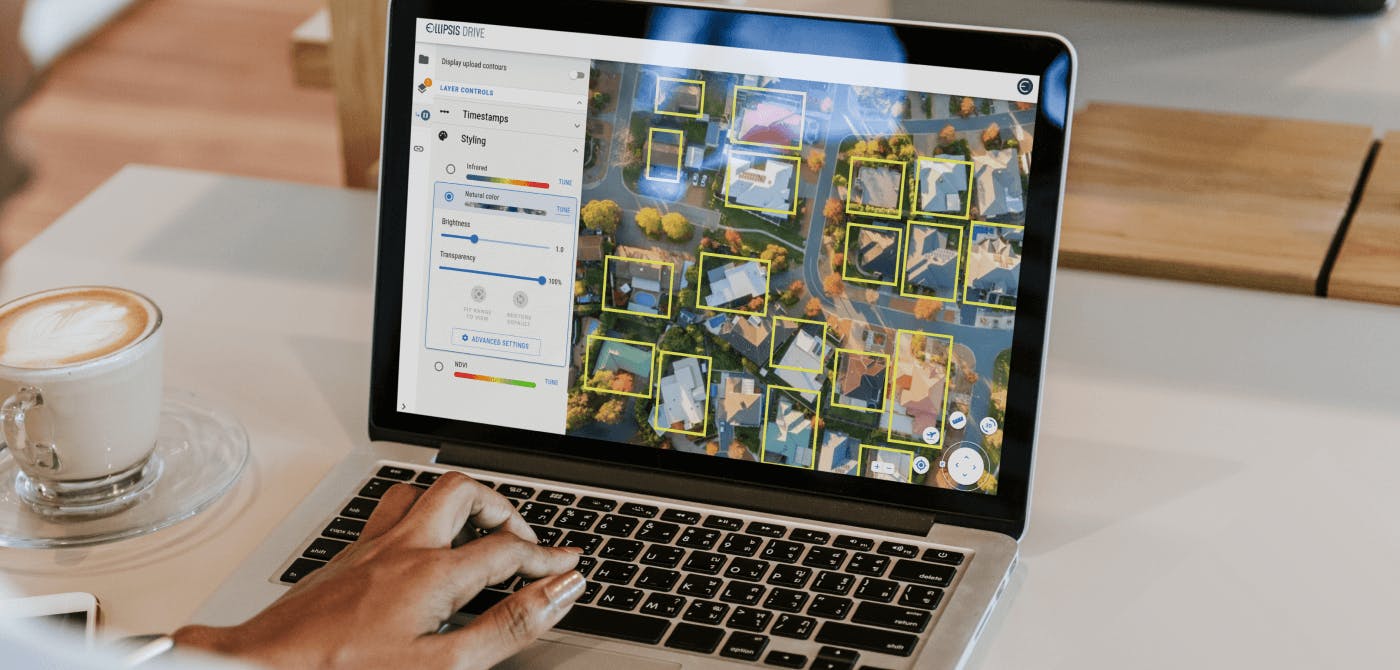

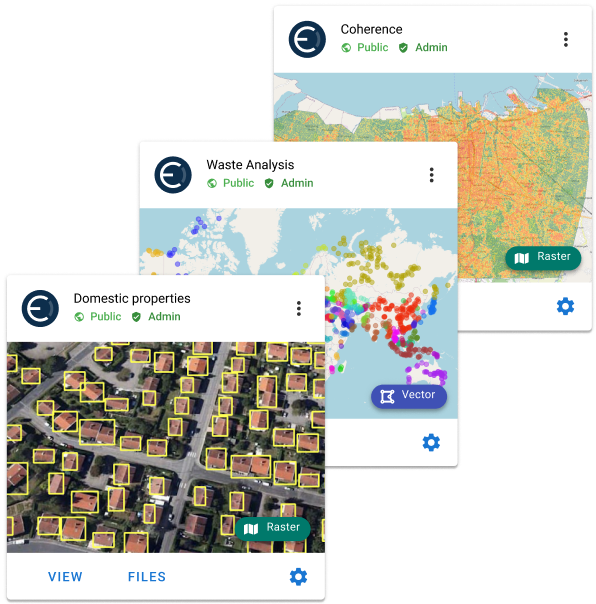

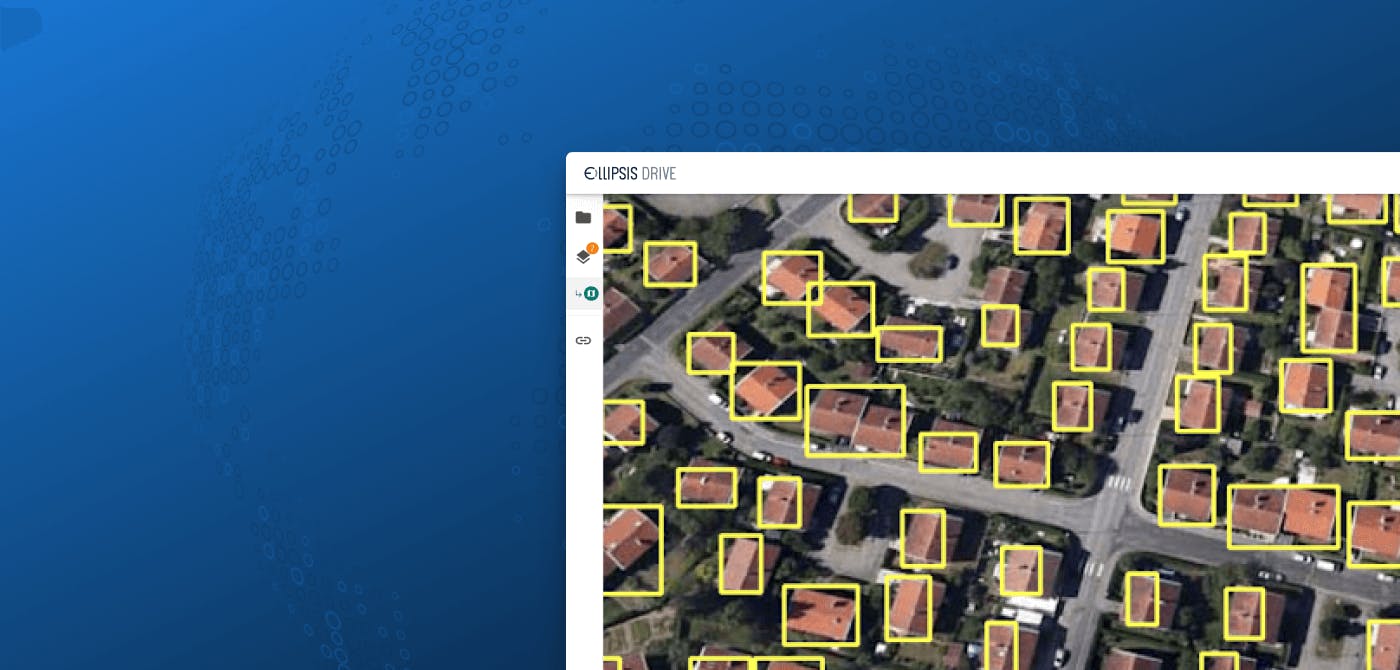

- Leverage advanced analytics and modeling techniques to analyze and visualize spatial data effectively.

- Utilize geospatial analytics tools to identify patterns, correlations, and predictive insights that enhance risk assessment and decision-making processes.

Best Practice 3: Clean spatial data management

- Automate spatial data ingestion, unification and standardization.

- Maximize interoperability to facilitate simultaneous use via fitting endpoints by any workflow, system or professional group downstream.

Best Practice 4: Data Governance and Ethics

- Develop robust data governance frameworks to ensure ethical and responsible use of spatial data.

- Implement transparent data governance practices, including data anonymization, consent management, and compliance with relevant regulations.

By implementing these best practices, insurers can effectively harness the power of spatial data, overcome challenges, and unlock the full potential of location-specific insights for driving sustainable insurance practices.

Conclusion

The link between the Insurance Sustainability Accounting Standard (ISAS) and spatial data is critical in driving sustainable practices within the insurance industry. By incorporating spatial data into sustainability reporting, insurers can gain a deeper understanding of location-specific risks, make informed decisions, and develop tailored strategies to address environmental and social challenges.

Spatial data integration enhances underwriting practices, risk assessment, and product development within the ISAS framework. It allows insurers to identify high-risk areas, tailor underwriting policies, and assess the social and environmental impacts of their offerings in specific locations.

Through real-world case studies, we have seen how insurers leverage spatial data to drive climate change mitigation, responsible investment decisions, and stakeholder engagement. These examples demonstrate the practical applications of spatial data within the ISAS framework, resulting in positive environmental and social impact.

While challenges exist in implementing spatial data integration, insurers can overcome them through best practices such as data partnerships, advanced analytics, clean data management and robust data governance frameworks.

By recognizing the critical link between ISAS and spatial data, insurers can position themselves as leaders in sustainable insurance practices. Leveraging spatial data empowers insurers to make informed decisions, mitigate risks, and contribute to a more sustainable future for the industry and society as a whole.

Liked what you read?

Subscribe to our monthly newsletter to receive the latest blogs, news and updates.

Take the Ellipsis Drive tour

in less than 2 minutes'

- A step-by-step guide on how to activate your geospatial data.

- Become familiar with our user-friendly interface & design

- View your data integration options

Related Articles

Tackling Land Subsidence with Ellipsis Map Engine

Pipeline infrastructure is central to the Oil & Gas industry, enabling the safe and efficient transport of resources across long distances. But this infrastructure faces constant threats from natural

5 min read

Opportunities for the Insurance Industry (2023)

What is the difference between a challenge and an opportunity? It could be argued that they are one and the same. That a challenge is just an opportunity in disguise. In need of someone to innovate a

7 min read

How to Build a Spatial Data Catalog

Let’s start off with a hypothetical example. Say you are the manager of an Amazon warehouse and you receive an order to ship a book (maybe The Salt Path by Raynor Winn). But none of the million thing

5 min read