Insurance Analytics

Opportunities for the Insurance Industry (2023)

Contents

Introduction

What is the difference between a challenge and an opportunity? It could be argued that they are one and the same. That a challenge is just an opportunity in disguise. In need of someone to innovate and create a feasible solution around it that opens up new doors.

The insurance industry is at a critical juncture in its evolution and there is a need to turn real challenges into real opportunities in disguise. Success will depend on how you choose to approach a situation and more importantly, how you choose to act.

Technological advancements and innovations have the power to turn threat into opportunity, so positive things could be in store for the world of Insurance. Still, an inability to evolve and adapt quickly enough can also prove to be a downfall for those who get anchored down in old ways.

Vintage (re)insurance companies run a risk of the latter. Fresh scale ups and start-ups have identified this shortcoming and have started to make inroads into their market share.

In this article, we’re going to highlight the challenges that the insurance industry is facing. And we’re also going to highlight how these challenges can be converted into opportunities. Stay tuned!

Challenge 1: Version Control

The insurance industry is the OG big data industry. For years it has relied on historical data for creating models and fine-tuning their risk pricing and policy creation processes. You’d think that the sheer amount of data that is generated in today’s Information Age would sharpen their workflows.

But on the contrary, it is the complexity that comes along with this ocean of data that, in some ways, has done more harm than good for the industry.

Insurance analytics requires collaboration of the highest order. Countless stakeholders interact, share their datasets and work together. It involves constant back and forth and exchange of information.

Complex permission structures, broad internal and external data usage and constantly updating datasets, make access management and version control a real headache.

When internal and external users of this data are not able to draw from a single source of truth simultaneously while real-time changes occur, a lag enters and version control spins out of control more and more with every edit and every iteration.

Now in this current workflow, developers and data engineers constantly need to transform and curate new data versions and perform all the checks on it from scratch. They need to affirm the accuracy and standardization of the data that they are working with and ensure unity in their data lakes and warehouses.

You can imagine how frustrating it must be for stakeholders (if this is you -> our heartfelt condolences). They end up spending more time on cleaning and transforming data than on actually using it for analysis. This adds to operational inefficiencies, bugs, poor rendering performance and querying speed, as well as poor challenges around real time data availability. NOT ideal.

The Opportunity

Automatic versioning or version control is a big aspect that is missing from the current system.

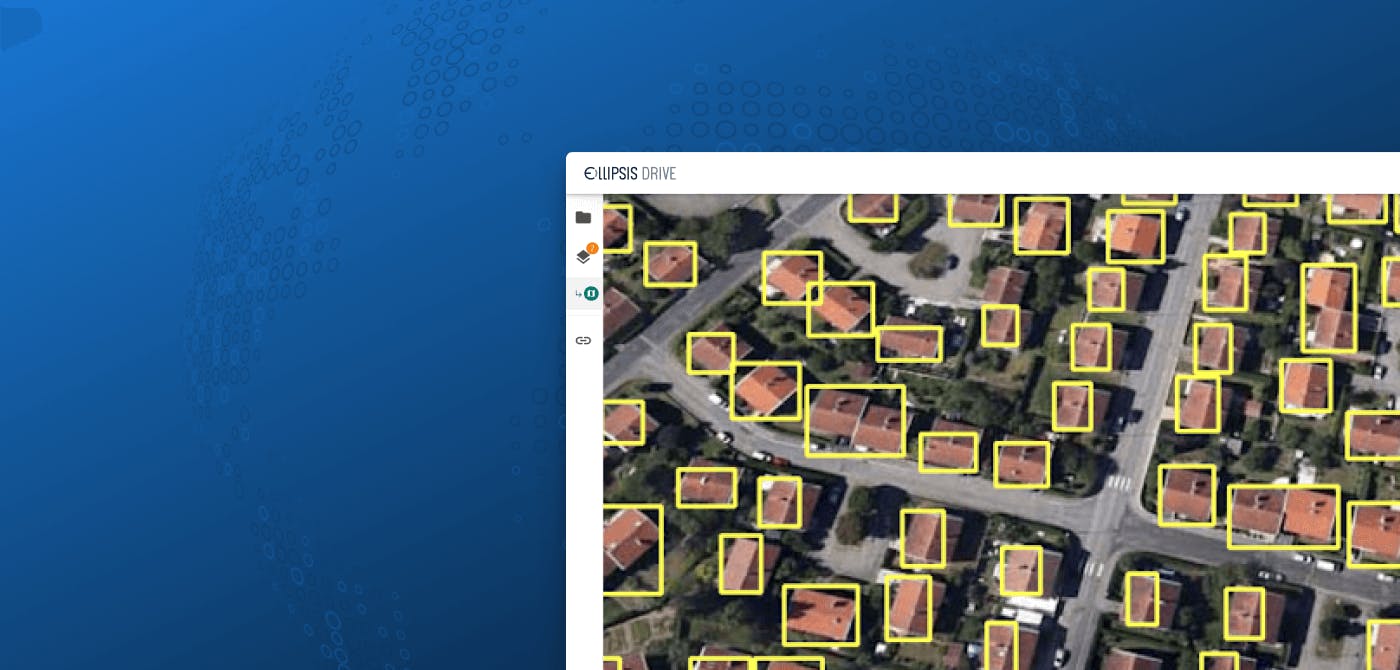

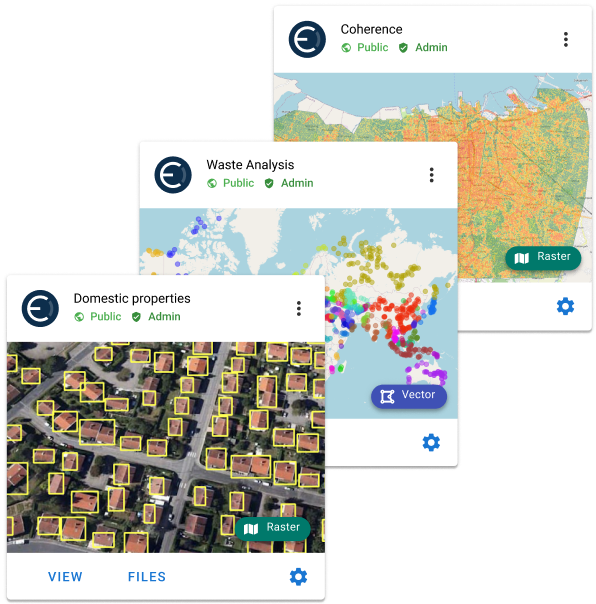

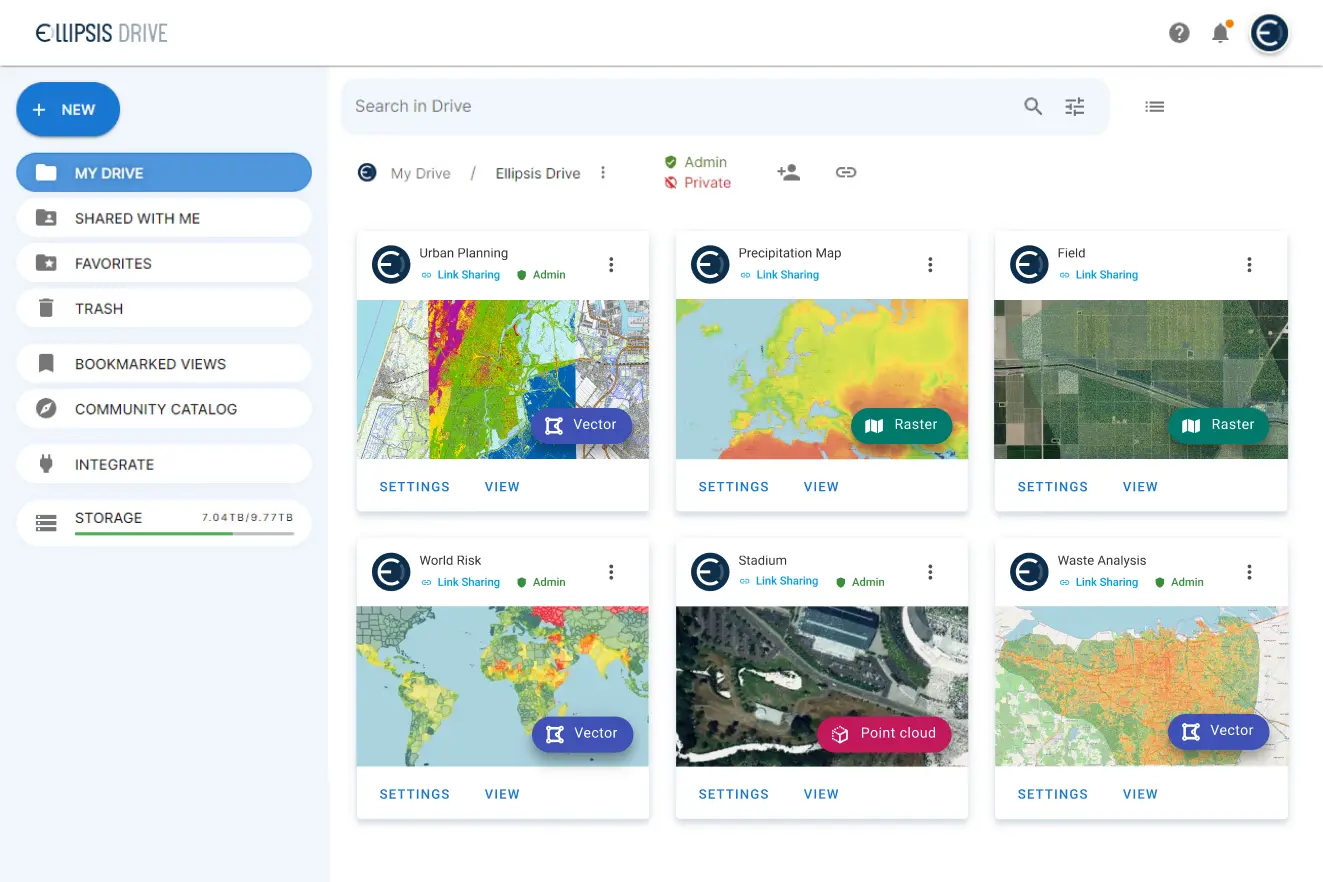

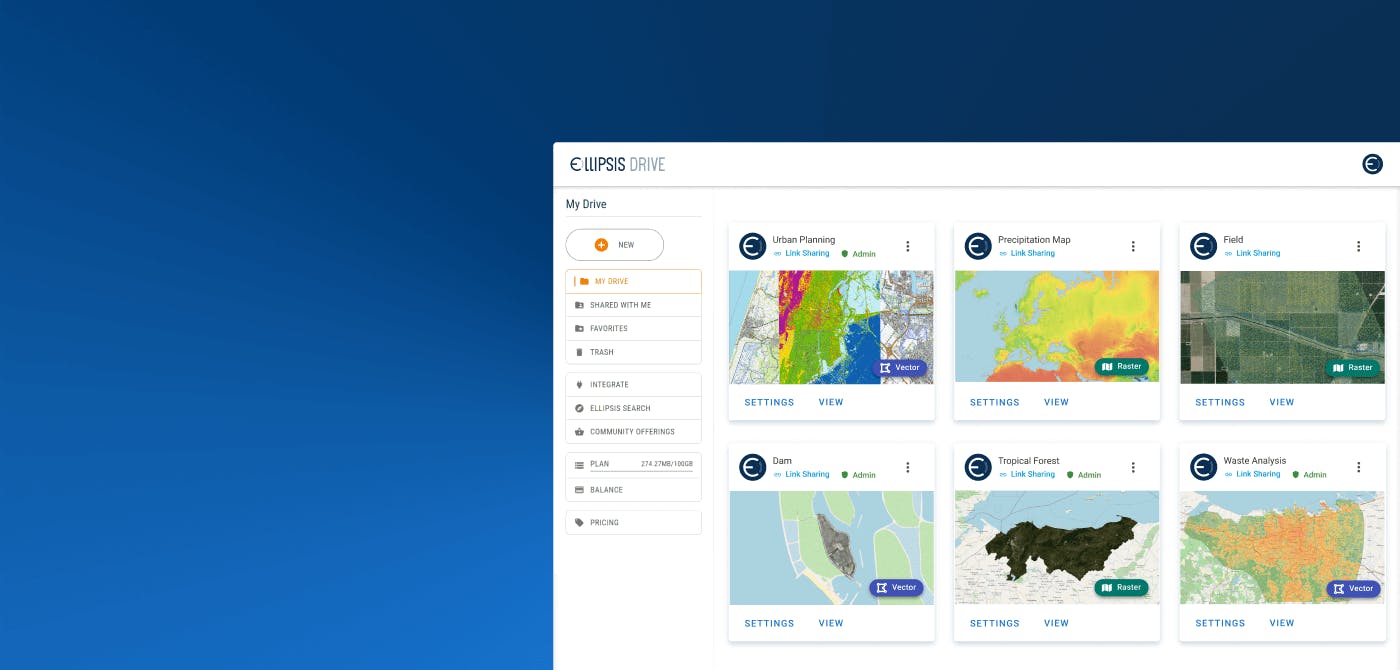

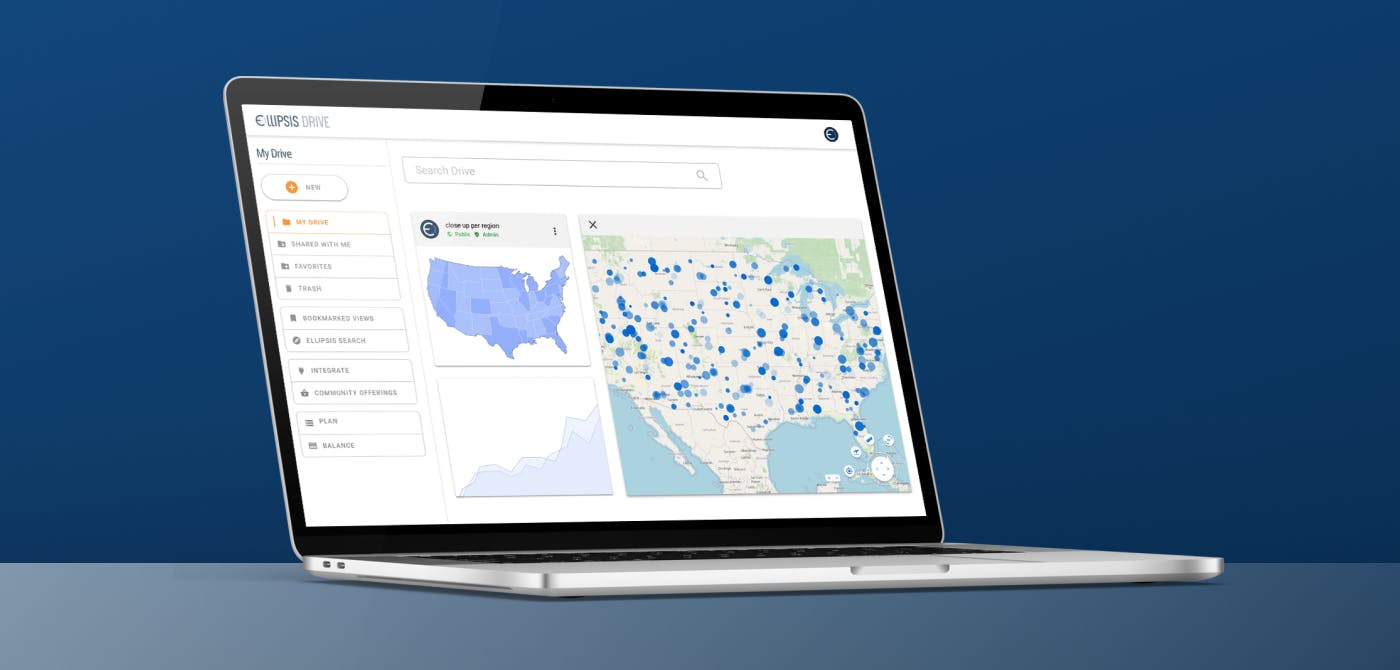

The opportunity lies in building out a conducive and common platform that converts spatial data files into interoperable web services that can be viewed, edited and integrated into downstream workflows in real time. This automatically incorporates the latest version in live products and services for countless stakeholders at the same time.

This frees up analysts and developers to focus their attention on doing the task that they enjoy and that adds real value: Analysis. The data wrangling part, which was never what they signed up for in the first place, is taken care of. Balance is restored!

Unsurprisingly, most insurers, reinsurers and brokers have improved their spatial data management on the road map for 2023 and 2024. Need to speed automation along? Feel free to get in touch.

Challenge 2: Adherence to Open Data Standards (ODS)

This brings us to challenge number 2. Here, interoperability is the crux.

As pointed out earlier, the insurance industry in general has several business verticals that work in tandem with one another. We’ll let the below image speak for itself.

Every collaborator is probably going to have a different data set, be it a climate datasets or demographic data sets. There is a sea of data out there. You’d think that too much of anything would not be a problem, but if not managed properly it can turn into a nuisance very easily.

The data generated by each of these standalone verticals is not always (or always not...) compatible and synchronized. We also need to account for the different software that each of these collaborators work with.

As a collective answer to these problems, the industry is moving towards the acceptance of Open Data Standards. Eventually this would level the playing field for the datasets and make life easier for all stakeholders and analysts in the future. But transitioning is where the inertia lies. And that is met with a lot of resistance from the Insurance industry.

The Opportunity

Why is this a challenge? Well, because who likes change? Admittedly, we like chance. But lots of people don’t get out of bed wanting to go about their work entirely differently. Even when the chance is supported to be a good one! When realizing that change usually also requires a lot of work (on top of the usual workload!), this reluctance is understandable.

Ellipsis Drive’ core competency and vision aligns with what the Open Data Standards (ODS) wants to achieve. Ellipsis Drive is a spatial data management solution that can be deployed on your own servers and databases to simplify and automate spatial data transformation, management and use/integration including the compliance to data standards.

We take the effort and inertia of ODS compliance off your plate and turn it into the strength, which it was innately meant to be.

Challenge 3: Scalability

Scalability is another issue that plagues Insurance stakeholders.

If you book successes with a pilot solution, you naturally want to scale it up. Easier said than done though.

As the scale of projects increases, the complexity increases exponentially. The little things that you get away with on a smaller scale, can not be dealt with in a similar manner when data, users, traffic, technical requirements and much, much more only grows. As such, to scale successful ideas into full blown product offerings, a price needs to be paid. Which is both good and bad.

You can imagine the complexity that comes with multiple products and solutions, each with different backend and frontend teams linking to the same data pool.

With this kind of structure, we can identify two types of pain points:

The first type appears during the process of getting the data into a data lake or data warehouse. Some of the most common challenges at that level are data unification and standardization, data curation, and data indexing.

The second set of pain points happen when the data is called upon by people working on the products and services that are powered by this spatial content. Here, our research demonstrated big challenges in searchability, access management, rendering performance and querying speed.

Bottom line, infrastructure that is simply not up to the task is a major bottleneck when looking to scale up.

The Opportunity

Specialized expertise and technologies are needed if you want to succeed on a large scale and outfit your infrastructure with what it needs to support growth.

Ellipsis Drive provides a solution that solves scalability problems. We help teams responsible for spatial data management launch their operations into the future without needing to migrate data out of their current systems or opening up their infrastructure to external parties. This solves the problems in-house while relying on fresh technology from out the door.

Conclusion

Did any of these challenges or opportunities resonate with you?

Can you visualize yourself doing better in your business endeavours by overcoming some or all of these challenges? The one who innovates is the one that sets the tone for the rest of the industry. And they indeed reap the benefits for their initiative.

It is time to cut the anchor line, lose the dead weights and move on to something bigger and better.

Be a trendsetter and get ahead of the curve.

Are you interested in having a conversation with us? Get in touch with us today

Liked what you read?

Subscribe to our monthly newsletter to receive the latest blogs, news and updates.

Take the Ellipsis Drive tour

in less than 2 minutes'

- A step-by-step guide on how to activate your geospatial data.

- Become familiar with our user-friendly interface & design

- View your data integration options

Related Articles

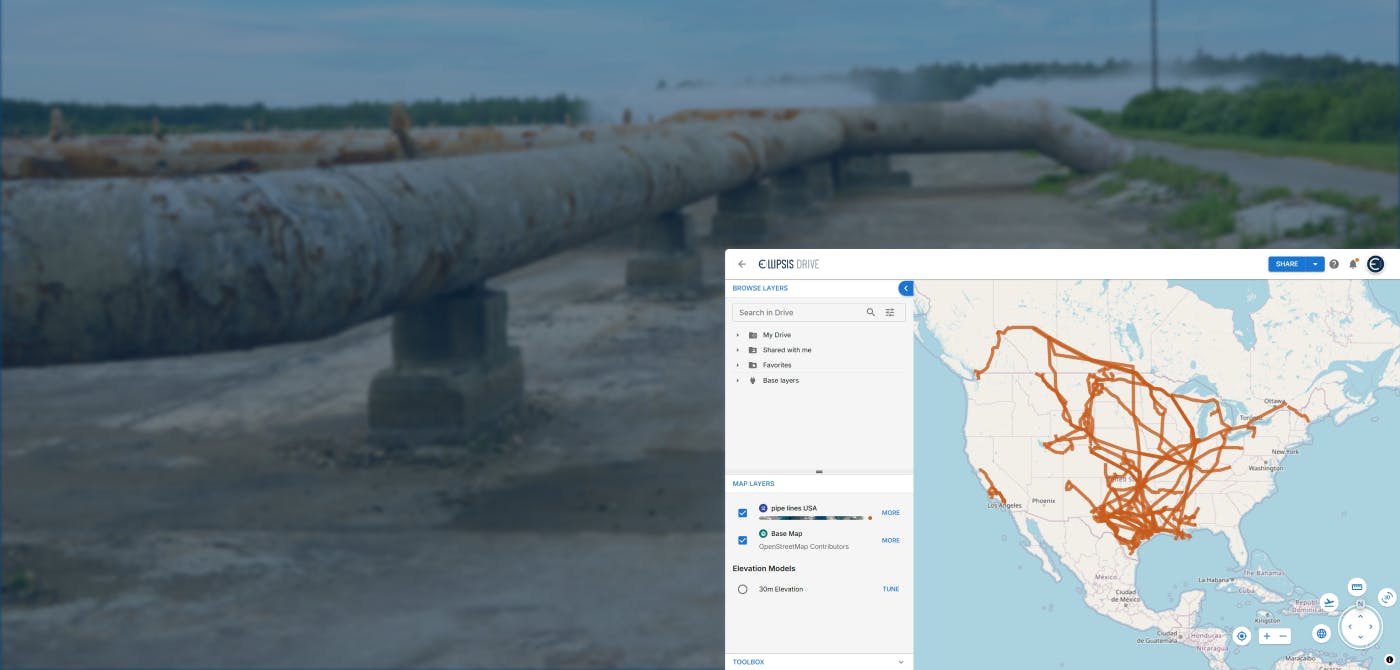

Tackling Land Subsidence with Ellipsis Map Engine

Pipeline infrastructure is central to the Oil & Gas industry, enabling the safe and efficient transport of resources across long distances. But this infrastructure faces constant threats from natural

5 min read

How to Build a Spatial Data Catalog

Let’s start off with a hypothetical example. Say you are the manager of an Amazon warehouse and you receive an order to ship a book (maybe The Salt Path by Raynor Winn). But none of the million thing

5 min read

Automating the Ingestion of Spatial Risk Data into Data Warehouses

In today’s data driven world, insurance companies are always seeking out new ways to enhance their decision making process and gain a competitive advantage. With the increased rate of natural catastr

5 min read